Avoid These Common Water Damage Claim Mistakes

by Admin

Posted on 26-06-2023 07:15 AM

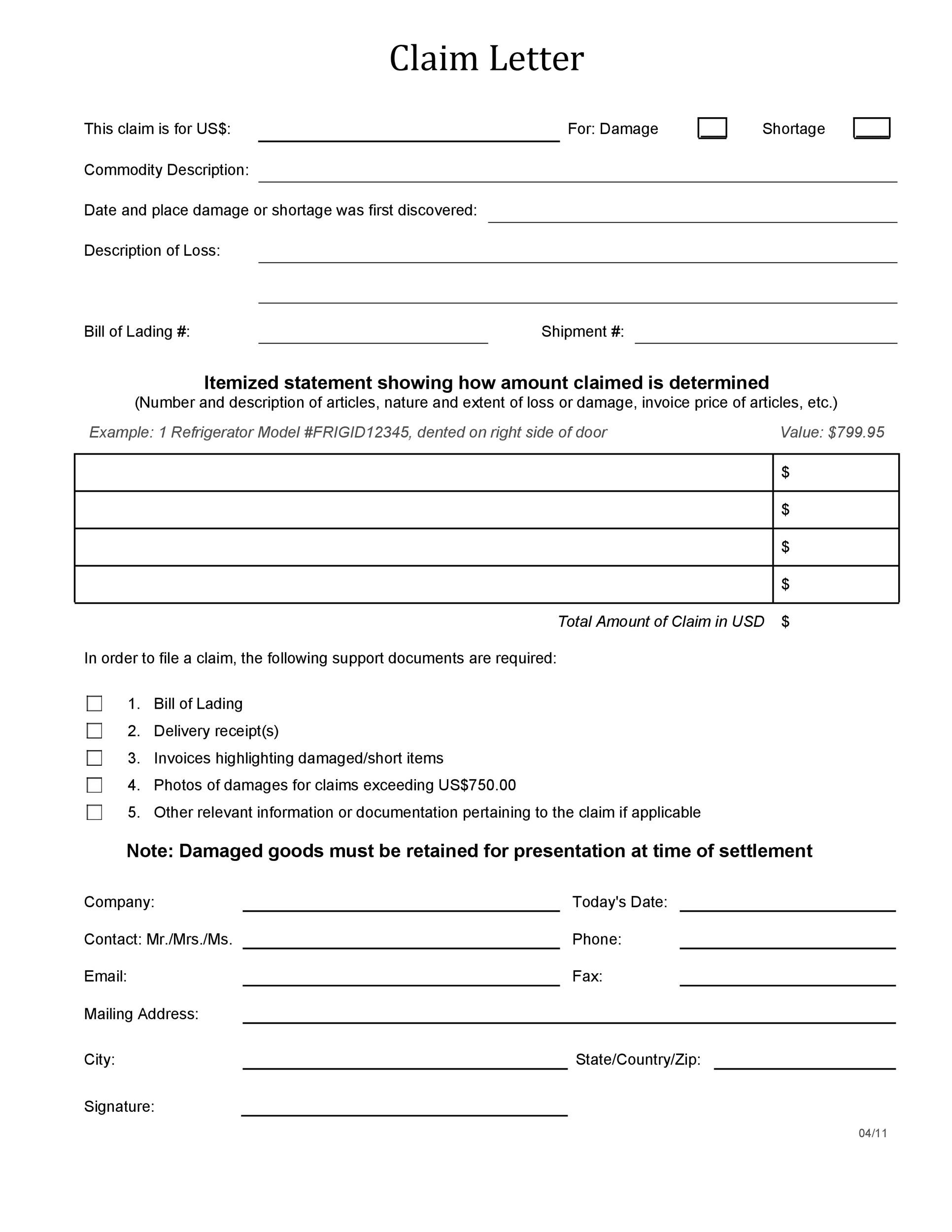

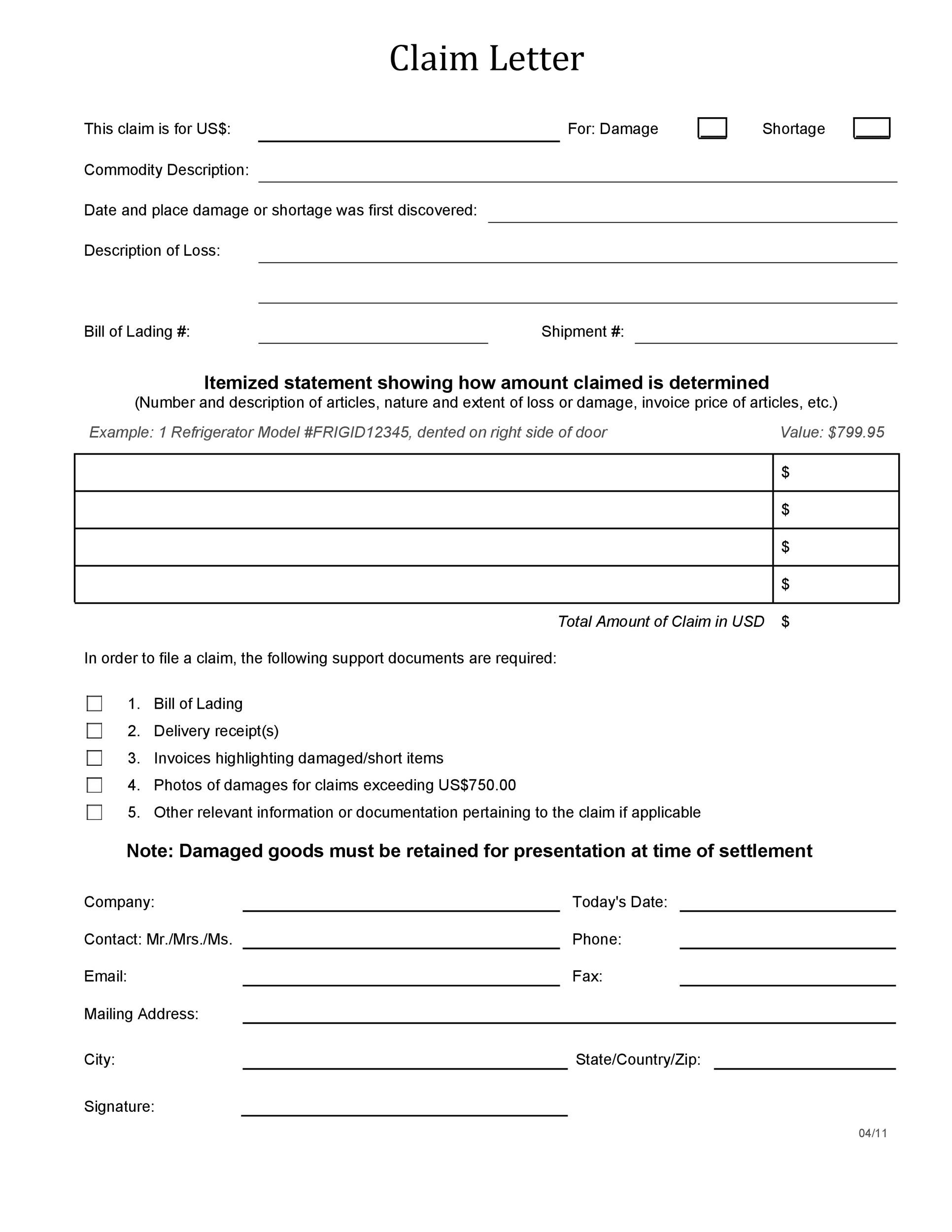

Water damage is the most common homeowners insurance claim in the u. S. File quickly to avoid having your claim denied. Keep in mind that insurance will only cover incidents that are sudden or accidental water damage and insurance companies often

create

exceptions—which could leave you fronting the price of repairs on your own. You come home to a burst pipe and a flooded basement. Or maybe it’s a water spot on your ceiling—a sign that something’s wrong with a pipe underneath the plaster. The bad news—it’s probably water damage. The good news is you’re not alone. According to the.

Dealing with Water Damage Claim Denials

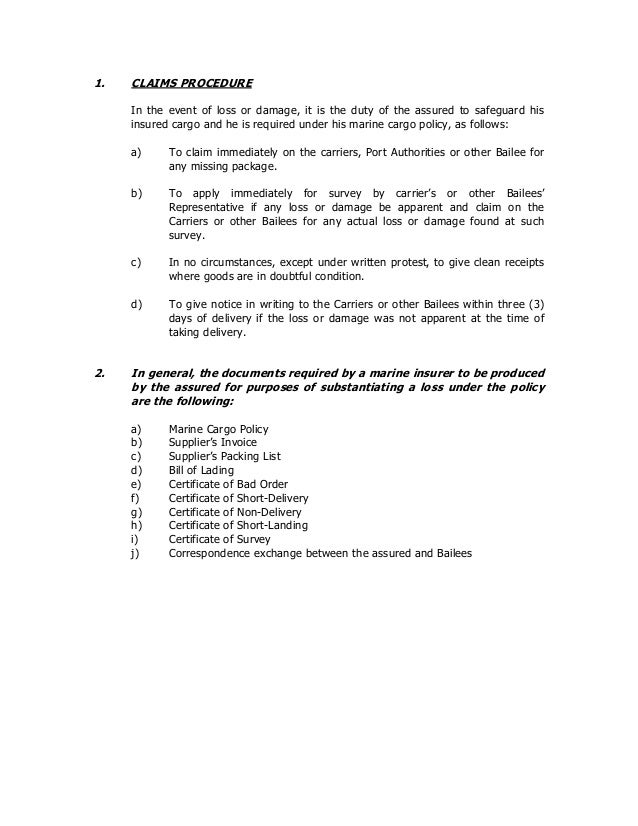

It is important to remember that anything you say to your insurance company at this stage may affect your flood damage claim. It is best practice to not dispose of anything until your property has been inspected by a loss adjuster (appointed by your insurance company). It is your responsibility to prove your loss so ensure that you do not disrupt your water damage claim by disposing of any evidence. Your insurance company will employ a loss adjuster to ‘adjust’ your flood damage claim. They are engaged by your insurance company to settle your claim as economically as possible.

Dealing with a disaster in your home is overwhelming. When your home is damaged due to water, fire, mold or trauma, you may be stuck wondering how you should proceed, with a million questions running through your head, including: who can help me fix this damage? should i call my insurance company? does my insurance cover this disaster? do i need to take pictures? will my insurance cover the cost to rebuild or repair the damage? first and foremost, you should know that there are specific companies that can help you through the entire process – disaster relief companies , whose job it is not only to clean up the damage but also to gather evidence, to work with the insurance, to fight to get your claims money, and some can even help you rebuild.

If you are encountering water damage to your property, a private public adjuster can be an invaluable asset in the process of filing and negotiating insurance claims. As knowledgeable professionals representing policyholders, they will provide assistance throughout each step of the claim's procedure to guarantee that their clients acquire equitable compensation from their insurers. Here are a few ways a private public adjuster can help you with your water damage insurance claim: if you're dealing with water damage on your residential or commercial property in florida, a private public adjuster can be a valuable resource to help you through the claims process.

About 95% of leak detections are part of an insurance claim for water damage. Depending on the insurance company, we find that dealing with an insurance claim can seem to be worse than the leak! whilst we cannot offer formal advice or assistance with a claim directly with the insurer as this is an fca regulated role, we have a wealth of first-hand experience in how the average claim proceeds and our customers’ experiences. You are welcome to ask our engineer to look at your policy as part of our leak detection process. The terms used are relatively common, and they are pretty familiar with finding the bits you need in the policy documents.

How to Choose the Right Water Damage Restoration Company

While maintaining thorough documentation is one of the most important aspects of a water damage restoration job, it is not always as easy as it sounds. Only time and experience can teach someone how to effectively document water damage restoration jobs. One key aspect of this is learning what to be thorough about. Take copious notes on any specific part of the restoration job that was abnormal for some reason. As the owner/manager of a cleaning and restoration company, it’s important that you teach your employees the appropriate skills for doing this.