Going Away? Keep Your Property Safe

by Admin

Posted on 16-06-2023 11:03 AM

You can normally make a claim by phone or on your insurer’s

website

.

Many insurance providers have a claim section on their site that allows you to apply online or download a form that can be emailed to them. If you have lost any belongings or there is a crime involved, you will need to report it immediately. Remember, your insurer is likely to need this information for their records and may refuse to pay out without it. Once you’ve done that, think about who else you might need to call. If your home has been badly damaged because of a fire, for example, you may need to vacate the property temporarily until it’s safe to live in.

Many insurance providers have a claim section on their site that allows you to apply online or download a form that can be emailed to them. If you have lost any belongings or there is a crime involved, you will need to report it immediately. Remember, your insurer is likely to need this information for their records and may refuse to pay out without it. Once you’ve done that, think about who else you might need to call. If your home has been badly damaged because of a fire, for example, you may need to vacate the property temporarily until it’s safe to live in.

When a burglary involves forcible entry, you need to safeguard your property and protect your family from further intrusions. Do the necessary emergency repairs, such as replacing windows or doors that were damaged during the break-in. Save your receipts so you can be reimbursed by your insurance company.

Assess the situation : take a deep breath and assess the situation. Do a quick overview of the damage. Take steps to prevent further damage (shut off the power) and protect your family. If it is not safe, go outside. If a burglary took place, call the police to file a police report. Contact your insurer : notify your insurer as soon as possible. They will assist you with starting the process and assigning an adjuster. Your insurer can help you find local contractors to help you secure your property. Document the damage : take pictures and video of all damage.

Yes, you're normally expected to give the insurer any evidence it asks for - this sometimes includes any broken items. You might need to support your home insurance claim with evidence such as: receipts for any of your stolen or damaged valuables any credit card or bank statements that show proof of buying the items photos of any damage caused and photos of your belongings if you’ve got cctv footage of the incident, make sure the data is safe and reliable. You may also record stolen items on online property databases such as: immobilise report my loss checkmend recording your items this way means there’s a permanent record the police could check against.

What to Do If You Experience Vandalism, Theft or Burglary

Household contents insurance (hausratversicherung) is necessary to indemnify you for loss of, or damage to your possessions. Included are all belongings contained in your home, such as furniture – including (optionally) built-in kitchen units -, clothing, collectibles, sports equipment, valuables and computers for personal use. Fixtures and fittings attached to the building and not owned by you are generally excluded as these are the responsibility of your landlord or the house owner under their own separate insurance policy.

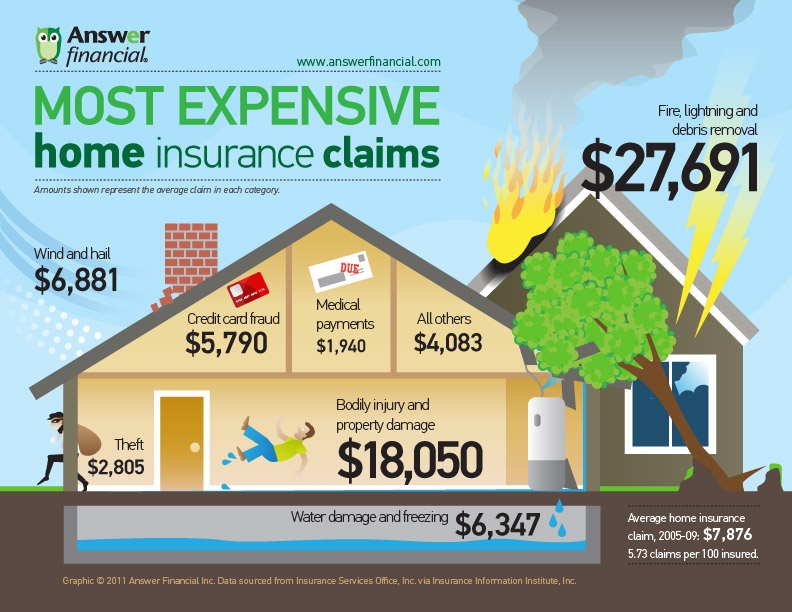

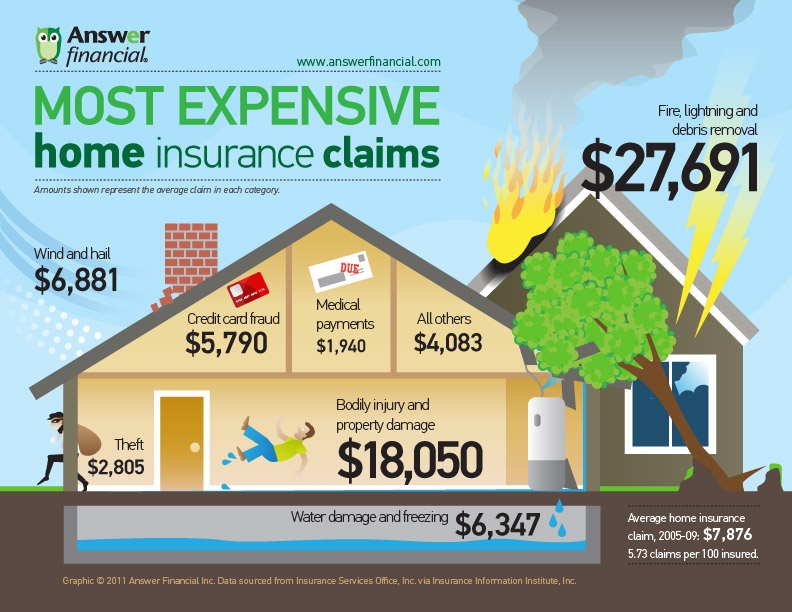

The coverage includes the risks of fire, burglary, storm damage, water damage and/or vandalism. Coverage outside the premises (for instance, robbery) is often limited up to approximately 10-15% of the total insured sum.

The coverage includes the risks of fire, burglary, storm damage, water damage and/or vandalism. Coverage outside the premises (for instance, robbery) is often limited up to approximately 10-15% of the total insured sum.

Get Help with Your Claim from a Public Adjuster

Loss assessors , loss adjusters , public loss adjusters and insurance claims consultants are often collectively referred to as insurance adjusters. The role of an insurance adjuster varies depending on whether he represents the insurance company in the insurance claims process or whether he represents the customer. In the event that the insurance adjuster is representing the insurance company he is referred to as a loss adjuster. If the insurance adjuster represents the policyholder he is normally referred to as a loss assessor or on occasion as a public loss adjuster or an insurance claims consultant.