Avoid These Common Water Damage Claim Mistakes

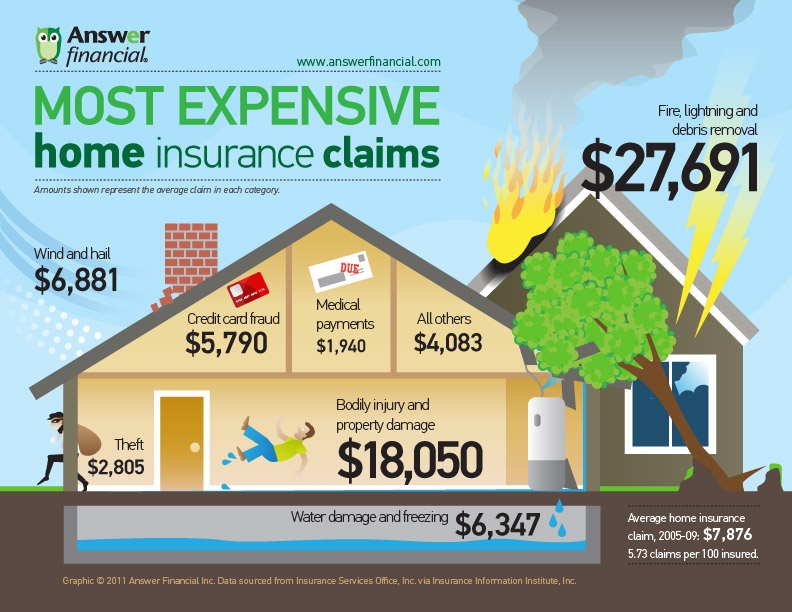

Water damage is the most common homeowners insurance claim in the u. S. File quickly to avoid having your claim denied. Keep in mind that insurance will only cover incidents that are sudden or accidental water damage and insurance companies often create exceptions—which could leave you fronting the price of repairs on your own. You come home to a burst pipe and a flooded basement. Or maybe it’s a water spot on your ceiling—a sign that something’s wrong with a pipe underneath the plaster. The bad news—it’s probably water damage. The good news is you’re not alone. According to the. Dealing with Water Damage Claim Denials It is important to remember that anything you say to your insurance company at this stage may affect your flood damage claim. It is best practice to not dispose of anything until your property has been inspected by a loss adjuster (appointed by your insurance company). It is your responsibility to prove your loss so ensure that you do not disrupt your water damage claim by disposing of any evidence. Your insurance company will employ a loss adjuster to ‘adjust’ your flood damage claim. They are engaged by your insurance company

read more →

Property Damage Claims: Theft, Burglary, Vandalism and Your Property

Many standard commercial property insurance policies will include coverage for vandalism , but not theft. Vandalism—the intentional and malicious damage or destruction of property—is often much less expensive than the theft of expensive computers and inventory. One of the biggest problems with theft or vandalism claims is the insurer’s reluctance to cover damages due to the cause of the loss. Here are a few examples to illustrate how the distinction between theft and vandalism can complicate a claim: vandalism turns into burglary. Young people vandalizing the exterior of a building may break a window, escalating the crime into theft when they find valuable items inside. In the event of a theft, vandalism, and/or burglary, you'll need to contact the police as soon as possible. In fact, reporting a theft or a home break-in is typically required in order to file a renters' insurance claim, assuming that your policy covers loss from theft. In addition, a police report will not only establish additional proof to show your renters' insurance company, but it can help the claims process run smoother as well. Be sure to get the names of any police officers you speak with just in case your insurance company has

read more →

Going Away? Keep Your Property Safe

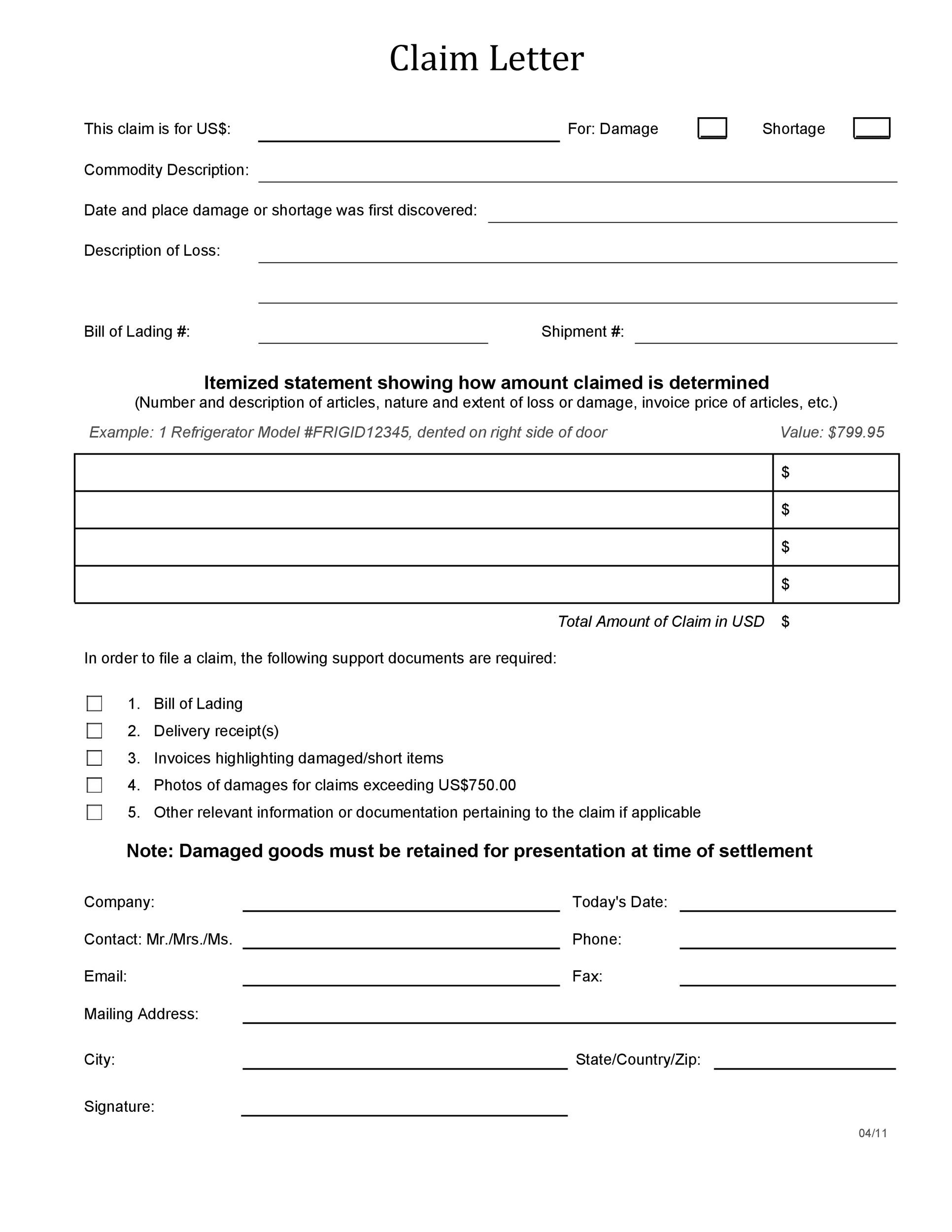

You can normally make a claim by phone or on your insurer’s website. Many insurance providers have a claim section on their site that allows you to apply online or download a form that can be emailed to them. If you have lost any belongings or there is a crime involved, you will need to report it immediately. Remember, your insurer is likely to need this information for their records and may refuse to pay out without it. Once you’ve done that, think about who else you might need to call. If your home has been badly damaged because of a fire, for example, you may need to vacate the property temporarily until it’s safe to live in. When a burglary involves forcible entry, you need to safeguard your property and protect your family from further intrusions. Do the necessary emergency repairs, such as replacing windows or doors that were damaged during the break-in. Save your receipts so you can be reimbursed by your insurance company. Assess the situation : take a deep breath and assess the situation. Do a quick overview of the damage. Take steps to prevent further damage (shut off the power) and protect your

read more →

Common Questions About Water Damage

Don’t settle for an unfairly underpaid claim. With unpredictable weather, storms, or even leaks, a water damage insurance claim can be a common issue for florida homeowners. From storm damage to broken pipes to ac leaks, sewage backups, and more, water damage is destructive and can even be life-altering. If you aren’t adequately represented or prepared to fight for a fair water damage claim settlement, you’re likely to receive one that won’t cover the cost of your repairs. Oftentimes, there’s a significant discrepancy between what the insurance company offers to settle a claim compared to the settlement you should receive. With the exception of fire, nothing is more destructive to homes than water damage. Water damage is one of the most commonly reported homeowners insurance claims, as well as one of the most costly. In 2020, water damage and freezing accounted for nearly 20% of all homeowners insurance losses , costing an average of $11,650 per claim. Without homeowners insurance, repair costs would be coming out of your pocket. Luckily, homeowners insurance covers water damage in various scenarios. Under the standard homeowners insurance policy, water damage must be internal and sudden to be covered. Your policy may also note

read more →

How to appeal a flood insurance claim

Contact your insurer or broker as soon as possible to check whether you have insurance coverage and, if needed, open a claims file as quickly as possible. Take every measure to avoid having the damage to your home get worse: limit infiltration and remove the water. Dry out and disinfect the areas in your home that were flooded. Keep receipts for all the expenses you incurred for accommodation or food, or to protect your home. If your company denies your claim or even part of your claim, do another review of your policy and see if you can appeal the denial. A first denial doesn't mean the insurance company won't issue a settlement; it may just mean it didn't have the necessary details or paperwork to pay the claim. An act of god is generally considered to be any event that’s outside of human control and is unpredictable and unpreventable. Natural disasters such as hurricanes, volcanoes, earthquakes, floods and storms are typical examples of such events. However, when it comes to insurance, the precise definition of an act of god is likely to vary depending on your insurer. This can cause ambiguity when raising insurance claims, so if

read more →Lightning Strike Insurance Claims & How to Prove to Your Insurance

State farm also used its claims data to rank the top five months for us lightning claims in 2021. It found that september was the month in which the costliest lightning claims were made, at $19. 5 million total. It was followed by august ($19 million), october ($13 million), november ($9. 8 million), and december ($9. 5 million). Citing findings from the insurance information institute, state farm said that ground surges account for 50% of lightning-related claims. This means that if lightning ever strikes near a home, it can cause a spike in electricity, shorting out electrical systems and electronics. Lightning strikes the earth about 100 times every second and can heat the surrounding air to up to 50,000 degrees fahrenheit ( the weather channel ). As such a destructive force, it’s no wonder lightning damage caused $790 million in homeowners insurance losses in 2015 and an average of almost $8,000 per paid claim ( insurance information institute ). Moreover, these amounts are expected to rise as the average number and value of electronics within a home increases. The rising cost of lightning damage claims illustrates the importance to insurance carriers of properly identifying the peril prior to

read more →Insurance Claims Tag Cloud

While it's not a requirement to use a preferred contractor to work on your insurance claim, there may be some items to consider when choosing your own versus a preferred vendor. A preferred vendor may be able to be paid directly from your insurance policy benefits. If you have a mortgage on your home, your insurance company will likely make any claims payment to you and your mortgage company. To pay for your repairs, your mortgage bank must endorse the claims check before you can cash it and pay your contractor. You're responsible for paying your deductible, which you determine through your policy and coverage choices. Our Insurance Claims Services Safety is the priority - don’t do anything that puts anyone at risk. If you were directed to evacuate your property, only return to your property when emergency services give the go ahead. If water has entered the property, don't turn on the electricity until it has been inspected by an electrician. Contact your insurance company as soon as possible to lodge a claim and seek guidance on the claims process. Let your insurer know if you've sustained roof damage. Before you start your clean-up take photos or

read more →

Subsidence Damage Claim Assistance

Subsidence damage can result in a lengthy and complicated insurance claim. This homeowner and his wife had a stressful experience because of knock-backs in the process. However, when the situation became too overwhelming, a family member informed the homeowner of aspray. Through aspray’s persistence, the claim started moving again. Aspray put together a plan for reinstating the property in the next 12 months. The homeowner couldn’t have spoke highly enough about aspray. He really did not know which way to turn!. The division of reclamation is authorized to fill subsidence holes on both private and public property but is not responsible for structural damage to private homes or other buildings. Homes and private structures can be protected through your insurance company. Conventional homeowners insurance does not cover damage caused by mine subsidence. However, insurance protection sponsored by the state of indiana is available for homeowners through the mine subsidence insurance fund. This insurance is available in those counties most susceptible to mine subsidence damage. The cmis map viewer is beneficial in determining whether you live in or near an area where underground mining activity took place. Subsidence is caused by ground movements which impact the building foundations, often

read more →How Important is Oil Spill Assessment?

A natural resource damage assessment (nrda) is a legal process under state and federal laws to determine the type and amount of restoration needed to compensate the public for harm to natural resources and their human uses that occur as a result of an unauthorized release of hazardous substances or oil. The nrda process brings together technical and legal teams of natural resource trustees to complete the following objectives authorized under the clean water act , the oil pollution act , the comprehensive environmental response compensation, and liability act , the texas water code and the texas oil spill prevention and response act :. Marine environments are frequently exposed to oil spills as a result of transportation, oil drilling and fuel usage. An estimated 5000 tons of oil per year was spilled during the period 2010–2014 due to accidents, cleaning operations or other causes [ 1 ]. Crude oil constitutes a large reservoir of the highly toxic polycyclic aromatic hydrocarbons (pahs), which are rapidly released into the water column after the spill. As we all known, oil slicks over the sea surface not only limit gas exchange through the air-sea interface, but also reduce light

read more →

Why do I need a Loss Assessor?

Contact a company such as claims assist to undertake the burglary insurance claims problems that vary from the burglary insurance claims process, the incident specifics, garda crime reference numbers, security measures at your property – were they active or inactive when the theft occurred ? burglary insurance claim but no receipts, the variety of factors that can complicate or have a burglary or theft claim denied are endless. Having claims assist ireland loss assessors to represent & manage your burglary insurance claim is paramount to a satisfactory outcome & the full theft insurance claim settlement. Claims assist loss assessors can minimize the impact of this traumatic event by helping you deal with your burglary claim or theft claim through expert claims management communicating with the insurance company, gathering all the relevant data, looking after all the paperwork and making sure that you get the full compensation you are entitled to. In the event of a claim: immediately contact your insurance broker or insurer to report the claim and arrange an assessor to be appointed, if required. Return a claim form as soon as practicable (within 7 days). In the event of burglary, malicious damage and/or money loss immediately report the

read more →